KCB Group PLC posted a 40 percent drop in first-half pre-tax profit attributed to the effects of coronavirus pandemic and its impact on its loan-loss provisions.

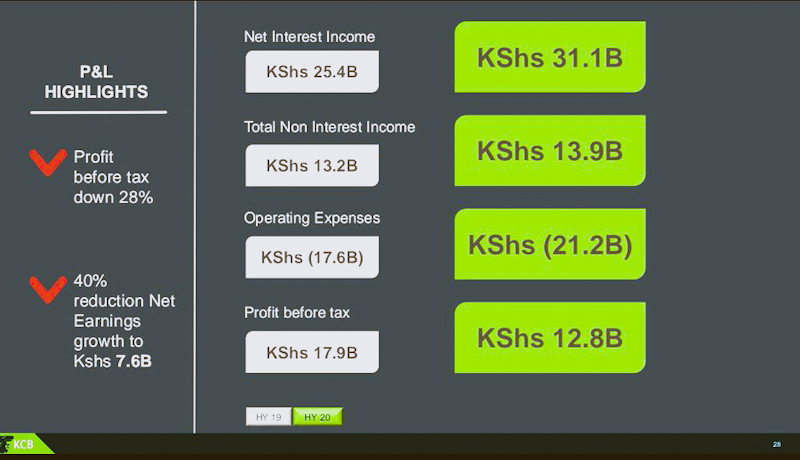

Its after-tax profit dropped to Ksh 7.6 billion while pretax profit declined to 28 percent to Ksh 12.82 billion.

“The second quarter was the toughest in our recent history as the pandemic hurt economic activity across markets,” Chief Executive Joshua Oigara said in a statement.

KCB Group Plc posted KShs 7.6 billion in after-tax profits for the first six months of 2020, marking a 40% decline from the previous year. This was largely caused by

increased provisions in the wake of higher credit risk due to the COVID-19 pandemic. pic.twitter.com/M9bPdtokuJ— KCB Group (@KCBGroup) August 12, 2020

“We project a continued strain on the business and economy in the remaining part of the year as the COVID-19 pandemic evolves. We will accelerate our support to customers, roll out cost management initiatives and seek avenues to boost efficiency though digitization to cushion the business from emerging pressures,” added Mr Oigara.

Total operating income increased by 16.6 percent to Ksh.45 billion from Ksh.38.6 billion.

Net interest income rose to Ksh.31.1 billion from Ksh.25.4 billion while non-interest funded income improved to Ksh.13.9 billion from Ksh.13.2 billion.

The bank’s balance sheet further expanded as total loans to customers and customer deposits increased to Ksh.559.9 billion and Ksh.758.2 billion respectively.

On the other hand, its operating expenses rose by 55.6 percent to Ksh.32.2 billion from Ksh.20.7 billion last year. This saw its subsidiary-the National Bank of Kenya (NBK) slide back into a loss of Ksh.381.3 million from a profit of Ksh.107.8 million last year.

“The second quarter was the toughest in our recent history as the pandemic hurt economic activity across markets. Most of the key sectors were nearly shut down &our customers continue to face unprecedented challenges." KCB Group CEO Joshua Oigara pic.twitter.com/Vge0PH9kpv

— KCB Group (@KCBGroup) August 12, 2020

Consequently, KCB will not pay an interim dividend to its shareholders this year.

***

According to Sterling Capital’s HY 2020 Kenya Banks Earnings Update for KCB Group, “They expect the stock price to remain subdued due to reduced profitability and lack of an interim dividend.”

Performance FY2020 will be significantly impacted by the pandemic that has seen economic performance dwindle across all the operating markets reducing customers’ ability to service their loans and reducing the demand for credit. “We expect the group to continue investing in government securities to reduce potential losses brought about by lending to the retail sector.”

READ