Opportunity in Kenya’s retail sector is within the county headquarters according to a report published by Cytonn Real Estate.

The demand is being driven by devolution and the increased retail business to serve the increasing urban population.

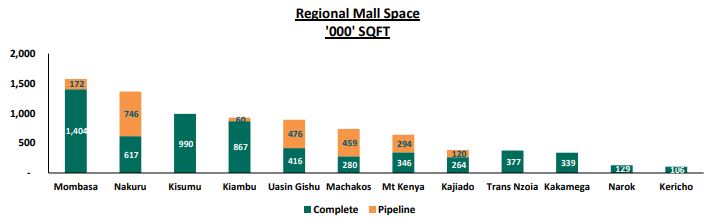

For instance, in Kisumu and Mt. Kenya regions, the retail space demand of 0.3mn and 0.2mn SQFT has attractive yields at 8.3 per cent and 9.9 per cent and occupancy rates at 96.3 per cent and 84.5 per cent, respectively.

This is, compared to the market average rental yield of 8.6 per cent and occupancy rates of 86.0 per cent.

However, the Nakuru region has the lowest average rental yield of 6.9 per cent.

According to the Cytonn Retail Report 2018, themed – Retail Sector Recovers in Key Urban Cities Except for Nairobi, this trend towards metropolitan areas and counties is because of the oversupply in Nairobi.

As a result, developers opt for other areas whose retail space supply is expected to grow by a 2-year CAGR of 8.0 per cent, 32.3 per cent, and 32.3 per cent, y/y.

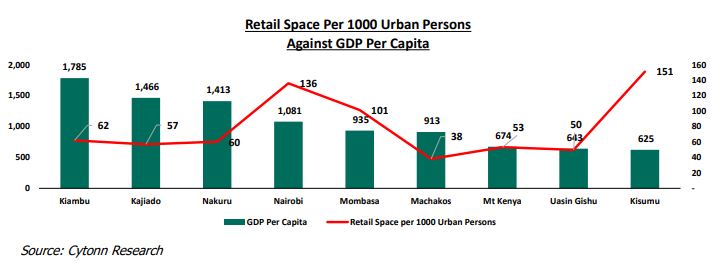

The data also indicates that “Nairobi has sufficient retail space supply factoring in incoming supply with a 2-year CAGR of 9.5 per cent to 7.8mn SQFT in 2020 from 6.5mn SQFT in 2018.”

The study says despite the high financing costs negatively affecting retail space development, improved infrastructure is opening up satellite towns to mall development.

For instance, Kiambu Road and Limuru Road as the most attractive for mall developers within Kenya’s capital satellite areas.

However, the increased supply of malls in the same region – Two Rivers Mall, Ciata Mall, and expansion of the Village Market- has resulted in stiff competition between them leading to a decline in occupancy rates.

“For example in Kiambu road, as a result of a 3.0 per cent increase in space, occupancy rates have declined by 11.2 per cent.

This is likely to result in the decreased development of malls in the City, already seen as supply increased by 4.8 per cent between 2017 and 2018, compared to growth with a CAGR of 15.9 per cent between 2010 and 2017.”

Cytonn further says “The retail supply is increasing at a decreasing rate, signifying that developers are cautious given the increased supply of approximately 4.5mn SQFT in the last 8 years.”

This collaborates Knight Frank’s 2017/18 Africa Report on Kenya that “Approximately 100,000 sq m of formal retail space was delivered to the market in 2016, up from about 50,000 sq m in 2015. As a result of this new supply, it has taken longer for space to be let and prime rents have stagnated.”

Kenya’s formal retail penetration is 30.0 per cent making it the second-highest in Africa, after South Africa’s 60.0 percent according to Nielsen Report.

The study on the supply of retail space was carried out in Nairobi Metropolitan Area, North Rift, South Rift, Coast, Western/Nyanza, and Mt Kenya regions.

1 Comment

Pingback: Carrefour to Foray into Western Kenya, Open 2 Stores in Kisumu