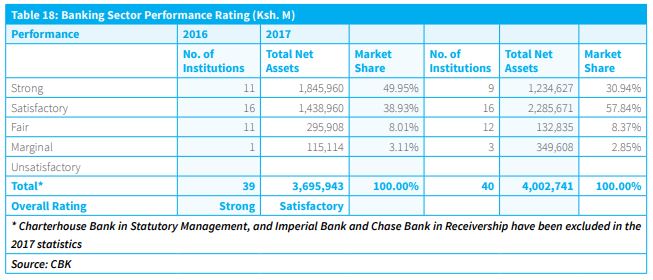

Kenya’s financial sector has been rated “satisfactory” due to reduced capital and a drop in asset quality compared to a strong rating which was achieved in 2016.

In its Bank Supervision Annual Report 2017, the Central Bank of Kenya (CBK) said, “The decline in the industry’s overall rating was mainly due to a decline in capital adequacy and a deterioration in asset quality in 2017.”

The institutions rated strong, satisfactory, fair and marginal in December 2017 were 9, 16, 12 and 3 respectively. The institutions rated strong decreased from 11 in 2016 to 9 in 2017.

During the period, fifteen banks were in violation of the Banking Act and CBK Prudential Guidelines as compared to twelve banks in the previous year, 2016 which was attributed to “to non-compliance with single borrower limit which was mainly on account of decline in core capital in some banks attributed to additional provisions for loans and advances.”

The Central Bank uses the Capital Adequacy, Asset Quality, Management Quality, Earnings and Liquidity (CAMEL) rating system in assessing the soundness of the commercial banks.