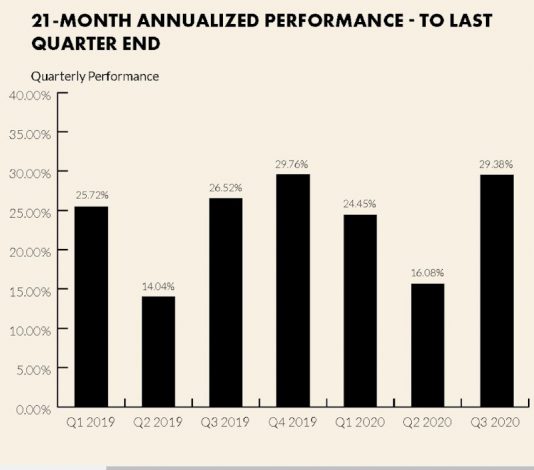

Standard Investment Bank’s Online Forex Trading Money Manager’s Q3 2020 performance for its MansaX product generated an annualized return of 23.3 percent for the 9 months of the year 2020.

This translates to a 1.21 percent increase compared to the same period in 2019 when MansaX reported an annualized return of 22.09 percent.

“In the final quarter of the year, our priority remains not only giving our clients the best returns but also maintaining the conservative trading model which ensures we protect investors’ capital. To that end, we will continue to trade cautiously, using our long/short model, which is ideal in the prevailing market volatility,” said Nahashon Mungai, SIB’s Executive Director for Global Markets in a statement.

MansaX is a global, multi-asset strategy fund that exposes retail and institutional investors to markets in five key asset classes including currencies, commodities, precious metals, global stock indices, and global single stocks as well as cash and cash equivalents.

According to the Capital Markets (Online Foreign Exchange Trading) Regulations, 2017, Non-dealing Online Forex brokers do not offer client advice or trade on behalf of their clients. Clients deposit their investment amount with an account to be offered by the broker.