Airtel Africa Plc has reported a sharp year-on-year rebound in profitability, with profit after tax rising more than fourfold to $156 million in Q1 FY2026, compared to $31 million in the same period last year.

The telco’s latest earnings, filed with the Nigerian Exchange, reflect strong execution across mobile services, data monetisation, and mobile money, buoyed by network investment and tariff optimisation.

“The scale and resilience of our performance in Q1 underscores the growing demand for inclusive, high-quality digital services across Africa,” said Sunil Taldar, Airtel Nigeria CEO.

“As smartphone adoption and mobile money usage continue to accelerate, we remain committed to removing friction points and delivering superior customer experiences.”

Financial Overview

| Metric | Q1 FY2026 | YoY Growth | Highlights |

|---|---|---|---|

| Profit After Tax | $156M | +408% | FX stability and higher operating profit |

| Group Revenue | $1.415B | +22.4% reported / +24.9% constant | Strong Nigeria and Francophone Africa growth |

| Mobile Services Revenue | $1.192B | +20.8% reported / +23.8% constant | Driven by tariff adjustments and rising usage |

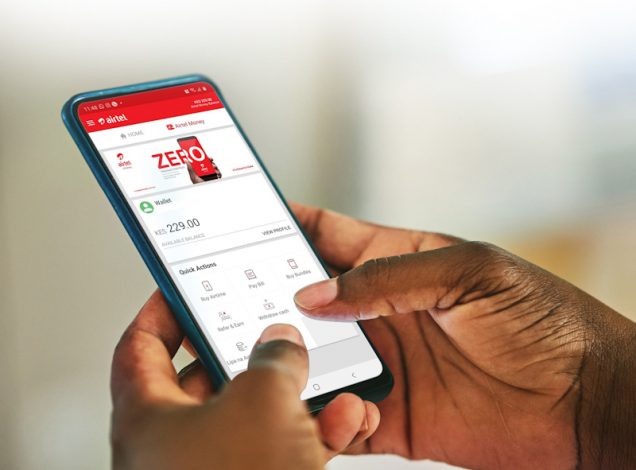

| Mobile Money Revenue | $290M | +31.0% reported / +30.3% constant | Fintech expansion in East and Francophone Africa |

| EBITDA | $679M | +29.8% | Margin improved 276 bps to 48.0% |

| Operating Profit | $446M | +33.0% | Reflects operating leverage and cost discipline |

| Free Cash Flow | $558M | +48.4% | Supported by timing of capex (down 17.7% to $121M) |

Commercial Momentum

- Total customer base expanded 9.0% to 169.4 million, driven by network expansion and improved churn metrics.

- Data subscribers rose 17.4% to 75.6 million, with monthly usage now averaging 7.8 GB per user.

- Smartphone penetration climbed to 45.9%, up 4.3 percentage points, aided by affordability initiatives.

- Mobile money platform saw 45.8 million active users, up 16.1%, with transaction value surging 35% to $162 billion (annualised).

Technology and Customer Experience

The launch of Airtel Spam Alert, an AI-powered tool to block fraudulent calls and SMS, marks the company’s latest effort to deepen trust and protect users across its footprint.

“We are leveraging technology to lower barriers to smartphone use and build safer networks,” said Taldar. “Digital inclusion remains central to our strategy, and with sub-50% smartphone penetration, the runway for growth is significant.”

Capital and Outlook

- Capex guidance for FY2026 remains unchanged at $725–$750 million, with spending directed toward 4G densification, 5G pilots, and fibre rollout.

- Despite capex timing lowering quarterly spend to $121 million, Airtel Africa continues to prioritise strategic expansion in underserved regions.

- The company’s partnership with SpaceX Starlink, now live in nine countries, is expected to unlock new connectivity-led revenue streams in enterprise, education, and healthcare.