With only 17 per cent of global Sustainable Development Goals (SDGs) currently on track, Standard Chartered Kenya has positioned sustainability as a core business driver.

In FY 2024, the bank accelerated its climate, finance, and social impact outcomes, delivering inclusive growth and resilience across Kenya’s development ecosystem.

“Sustainability is at the core of our strategy and is embedded in the way we do business, underpinning our brand promise, Here for Good,” said Kariuki Ngari, Chief Executive Officer, during the launch of the 3rd edition of their Sustainability Progress Report.

Record Growth in Sustainable Finance

Sustainable finance income rose by 132 per cent—from KES 1.29 billion to KES 2.99 billion. Sustainable finance assets also surged tenfold to KES 31.3 billion, reflecting robust client demand and a maturing ESG ecosystem.

“We believe sustainable finance is essential in addressing significant social and environmental challenges,” said Birju Sanghrajka, Head of Corporate & Investment Banking Coverage.

Products ranged from green and transition loans to Africa’s first Sustainable Savings Account, supported by 80 ESG bonds and 24 sustainability-linked funds.

Empowering Women and Microbusinesses

SC WIN surpassed KES 2.6 billion in assets under management, offering women-led businesses access to finance, global networks, and advisory services.

The Access to Finance programme deployed over KES 30 million in low-interest loans to microenterprises, creating 67 jobs in 2024 alone.

“I started Mauca Welders to prove women can thrive in fields dominated by men. Today I mentor others to believe in their potential,” shared Maureen, a programme participant.

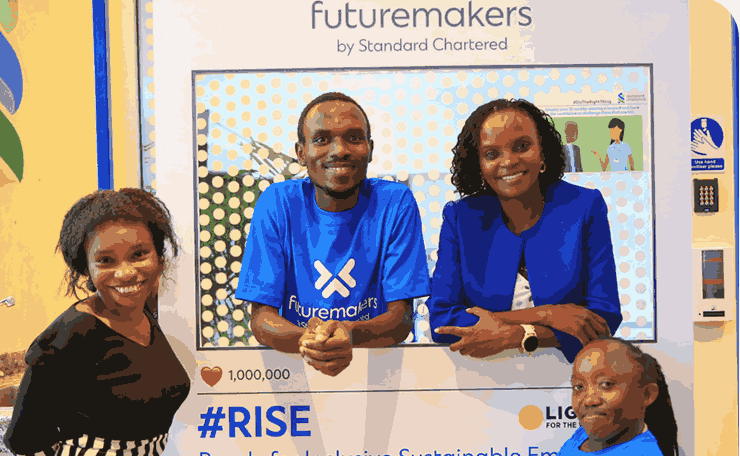

Futuremakers: Kenya’s Youth Empowerment Engine

Since 2019, Standard Chartered’s flagship programme, Futuremakers, has engaged over 54,000 Kenyan youth.

In 2024, the bank invested KES 133 million in a new employability programme designed to serve persons with disabilities and young women. More than 1,380 jobs have been created through supported microbusinesses.

“Futuremakers helped me register my own company and inspired me to support others,” said Josephine, a Futuremakers graduate.

Climate Progress Backed by Certifications

The bank reduced carbon emissions by 79 per cent, recycled 95 per cent of operational waste, and cut energy usage by 54 per cent. Its Chiromo Head Office refurbishment earned EDGE certification, while the bank became Africa’s first institution to receive the TRUE Zero Waste Platinum rating.

“Partnerships have been fundamental to our success. Working with the Nairobi Arboretum Conservancy Community Forest Association, we planted one million seedlings, contributing to Kenya’s national target of 15 billion trees by 2032. Through digital innovation, including conservation apps and QR-coded tree markers, we’re not just greening urban spaces—we’re shaping an environmental legacy that will outlive us all,” Kariuki Ngari, CEO, Standard Chartered Kenya.

A Sustainable Marathon for Inclusion

The 2024 Standard Chartered Nairobi Marathon injected KES 380 million into the Kenyan economy, drew 25,000 runners from 94 countries, and raised KES 48 million for youth programmes.

Over 93 per cent of waste was recycled, and 53,000 indigenous tree seedlings were distributed.

“SCNM sets the standard for sustainable public events and shows our commitment to diversity and green innovation,” noted the bank’s Sustainability Progress Report.

Embedding Ethics and Employee Engagement

Staff engagement reached new heights with an employee net promoter score of 39.08. More than 82 per cent of staff participated in volunteering programmes, contributing 3,501 hours in mentorship, financial literacy, and climate action.

The bank maintained 100 per cent completion in Code of Conduct and Financial Crime training.

“These milestones show that sustainability and integrity go hand in hand in creating a resilient and inclusive institution,” said Chairperson Kellen Kariuki.