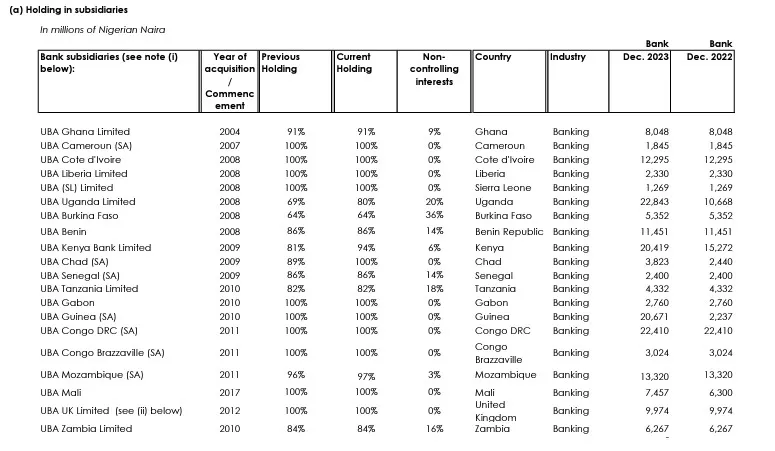

United Bank for Africa (UBA) has strengthened its presence in Kenya and Uganda, with 94% and 80% ownership as of the end of the fiscal year 2023, respectively.

According to the lender’s latest annual report (2023), “During the year, the bank made additional investments in four (four) subsidiaries (UBA Mali, UBA Chad, UBA Guinea, UBA Uganda, and UBA Kenya) totalling N38.297 billion. These additional investments have been reflected in the subsidiaries’ capital as of December 31, 2023, after getting approvals from the host regulatory authorities.”

UBA spent a total of NGN 18.49 billion ( $16.04 million) to increase its ownership stake in its Kenyan and Ugandan subsidiaries. This included NGN 6.96 billion ($6.03 million) to acquire an additional 11% stake in the Ugandan subsidiary and NGN 11.52 billion ($9.99 million) for a 13% stake in the Kenyan subsidiary.

UBA is headquartered in Lagos, Nigeria. It operates in 20 African countries, including Benin, Burkina Faso, Cameroon, Congo Brazzaville, DR Congo, Côte d’Ivoire, Gabon, Ghana, Guinea, Kenya, Liberia, Mali, Mozambique, Senegal, Sierra Leone, Tanzania, Chad, Uganda, and Zambia.

UBA’s reach extends beyond Africa, with a presence in the United Kingdom and France.

It’s also the only sub-Saharan African bank licensed to take deposits in the USA, solidifying its global position. In 2022, UBA expanded its international footprint by opening for business in Dubai, United Arab Emirates.