Kenya’s listed banks saw their quality of assets deteriorate in the third quarter evidenced by the rising non-performing loans.

This was attributed to the rising non-performing loans mainly in the manufacturing, retail and real estate sectors.

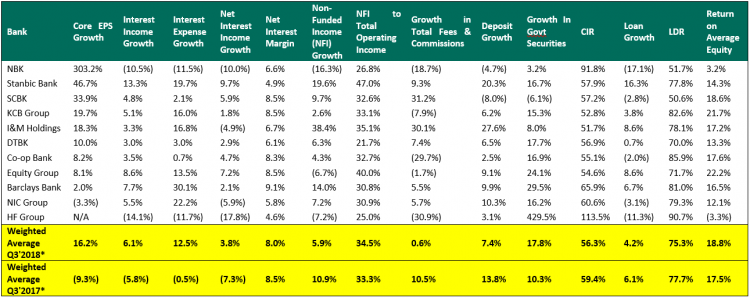

Cytonn Investments Q3’2018 Banking Sector Report, however, showed that an increased emphasis on operating efficiency by banks seems to be bearing fruit, with the listed banking sector’s operating efficiency improving, supported by revenue expansion as well as cost containment.

“The sector’s operational efficiency improved, as shown by the decline in the cost to income ratio to 56.3% from 59.4% in Q3’2017, supported by the improving total operating income, and lower costs, aided by the lower cost of risk due to reduced provisioning levels,” reads part of the report.

“The continued focus on alternative banking channels continues to boost their Non-Funded Income (NFI), thereby supporting the banks’ top line revenue under the tough operating environment of compressed interest margins,” said Caleb Mugendi, Senior Investment Analyst at Cytonn Investments.

In November, the Central Bank of Kenya (CBK) Monetary policy Committee had also observed that, “The ratio of gross non-performing loans fell to 12.3% in October from 12.7% in August largely due to declines in NPLs in the trade, and personal and household sectors due to sustained recovery efforts by banks.”

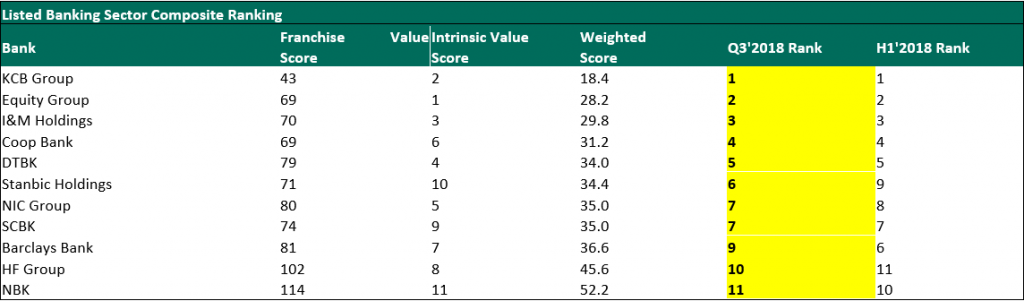

The report, themed ‘Deteriorating Asset Quality Dampens Growth, analysed the results of the listed banks using their Q3’2018 unaudited results to determine which banks are the most attractive and stable for investment from a franchise value and from a future growth opportunity perspective.

“We have looked at four key focus areas, which are regulation, diversification, consolidation and asset quality in this report. With a tighter operating environment, diversification of revenue, cost management and asset quality management will prove to be the key growth drivers for players banking sector,” said Mugendi.

“We expect banks to continue employing prudent loan disbursement policies, and consequently tightening their credit standards, in order to address these concerns around asset quality. This poses a challenge, as it points to reduced intermediation in the banking sector, between the depositors and the credit consumers, one of the banking sector’s main function,” said Faith Maina, Investment Analyst at Cytonn Investments.

Going forward, Cytonn projects likelihood of increased consolidation activity, as larger banks acquire the smaller players in the sector, who are constrained in capital. We may also see mergers and strategic partnerships between banks, aimed at creating larger entities with sufficient capital bases to pursue growth.

Read: NIC and CBA eye becoming 3rd largest bank in merger

In Q3’2018, bank deposits grew at 7.4% y/y, a faster rate than loans, which grew by 4.2%, with funds channeled towards government securities that recorded a high growth of 17.8% y/y.

The loan growth came in lower as private sector credit growth remained low, at an average of 4.4% in the 10 months to October 2018, below the five-year average of 12.5%, with banks adopting a more prudent credit risk assessment framework to ensure quality loan books so as to manage the rising non-performing loans, and the associated cost of risk.

KCB Group was ranked as the most attractive bank in Kenya, a position it has retained since FY’2016, supported by a strong franchise value and intrinsic value score.

Equity Group came second while Stanbic Holdings rose 3 positions to position 6 from position 9 due to an improved franchise value score, with the bank having the lowest NPL of 7.2%, lower than the industry average of 9.9%.

National Bank of Kenya ranked lowest overall, ranking last in both the franchise value score and intrinsic score.